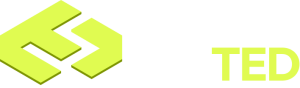

Cashwise is a neo-banking mobile application

My Role

Product Designer

Tools

Figma, Photoshop, Adobe Illustrator

Timeline

8 Weeks

Project Overview

Cashwise is a neo-banking mobile application with the goal of providing day-to-day payments and remittance services through its wallet system for businesses, Nigerians, and Africans in the diaspora. The Cashwise app was conceptualized by Cashwise Inc- a registered business in the United States of America. The Cashwise application will serve as a breath of relief to the Nigerian and African remittance market by facilitating seamless movement of funds from the diaspora to its corridors and vice versa.

Project Overview

Cashwise is a neo-banking mobile application with the goal of providing day-to-day payments and remittance services through its wallet system for businesses, Nigerians, and Africans in the diaspora. The Cashwise app was conceptualized by Cashwise Inc- a registered business in the United States of America. The Cashwise application will serve as a breath of relief to the Nigerian and African remittance market by facilitating seamless movement of funds from the diaspora to its corridors and vice versa.

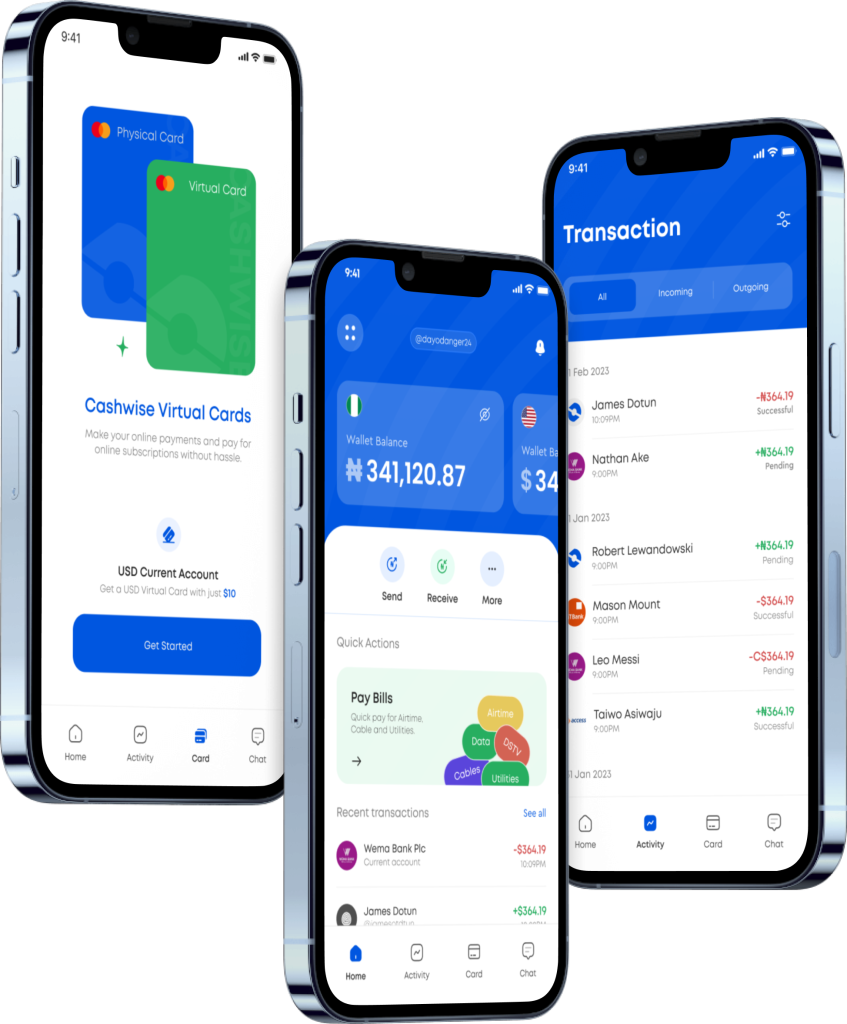

Design Process

01 Research

Research Plan

Research enables me to dig deep into my understanding of users – not only their immediate frustration, but also their hopes, fears, abilities, limitations, reasoning and goals. It lays essentials foundation for creating solutions in later stages.

To ensure the research stays on track and better guide the mobile aoo design, it is important to create a research plan before diving into the research phase. I listed research goals, research questions, assumptions and methodologies, participants and timeline below.

Research Goals

- Understand the market of Fintech-related companies

- Identify the target audience of Cashwise

- Learn about how the main competitors of Cashwise are catering to customer’s needs, as well as their strengths and weakness

- Uncover people’s experience of the competitors

Assumptions

- All users must have an internet-enabled smartphone

- All users on Cashwise must have a registered mobile phone number in their country of residence

- All users on Cashwise must have an address in the country of their residence

- Users (residents) in Nigeria must have a government-issued means of identification such as a National ID, Permanent Voter’s Card (PVC), Nigerian passport, Bank

- Verification Number (BVN) or driver’s license. The primary means of identification is BVN.

- All users (residents) in the diaspora (UK/USA/CA) must have a government-issued means of identification in the respective region.

- All users (residents) in the diaspora (UK/USA/CA) have at least one (1) bank account in their country of residence. This

Constraints

- Low internet accessibility/downtime will inhibit the usage/performance of the solution

- Users in the USA must have Zelle linked to their bank account for funding from their bank account and also withdrawing/sending USD to their own US bank account or a third-party beneficiary.

- Users in Canada must have Interac linked to their bank account to enable them to fund from their bank account or withdraw/send CAD to a Canadian bank account

- To send GBP to a UK bank account via TrueLayer, the user must input the recipient’s bank account number and sort code which will auto-lookup the account name.

- Users (residents) in Nigeria who wish to verify themselves using their National ID (vNIN) must generate the vNIN from their NIMC mobile app or dial the USSD *346*3*NIN*Enterprise code#

- The vein is only valid for 72 hours for verification purposes and must not be stored

Methodologies

- Secondary Research (Market Research, Competitive Analysis)

- Primary Research (User Interview

Secondary Research

Market Research

It is important to get a big picture of the market by starting with market research – to get a sense of what we know and don’t know yet, who the audience is, as well as what the recent trends or news are. The insights gathered from market research will help me frame provisional personas and ask meaningful questions in primary research.

- Overall: the Nigerian fintech industry has remained a greatly influential, promising, and biggest fintech app space in the world. Over the years, the fintech industry has remained a massive, greatly influential global consumer market, with 200 Fintech companies

- Generally, there are 3 types of fintech companies for users in Nigeria. The first type is an actual banking app where people can save and transfer money, more like the “banking industry gone technology”, the second type is the Microfinance banking system where the fintech company’s basic objective is to provide suit and comfortable loan, mortgage and what not to its user, while the third one is the for businesses and individuals to make their international remittance process seamless, this entails access to USD accounts and virtual cards to make international payment on various platforms around the world.

Demographics

Overall: A very high population of youths (Tech bros and Sis) in Nigeria would rather get access to their money right from their comfort zone than have to go to banks to make complaints and whatnot, especially given the fact that they can easily receive their wage right into their wallet and not having to go through the hustle of opening a Paypal account. Therefore they are likely to be the users of fintech products.

Competitive Research

It is equally important to research enterprises that pioneer in the fintech industry, as their solutions to similar problems will help me gather insights about their strengths and weaknesses. These insights also help me identify any gaps in features that Cashwise might address. I analyzed 3 direct competitors, who are trying to solve the same problem as cashwise.

Strength

- Use of USD Virtual Cards

- Easy navigation

- Access to local bank account

- Access to GBP account

Weakness

- Inoperative of Functionalities

- Easy security procedure

- Single method of Funds remittance

- No provision for a physical card

Strength

- Use of USD Virtual Cards

- Easy navigation

- Access to a local bank account

Weakness

- Boring UI

- Difficulty navigating

- Single method of Funds remittance

- No provision for physical cards

Strength

- Fast Verification Process

- Great UI

- Access to GBP Account

- Access to a local bank account

Weakness

- Boring UI

- Difficulty navigating

- In-app ads

- No provision for physical cards

- Long verification process

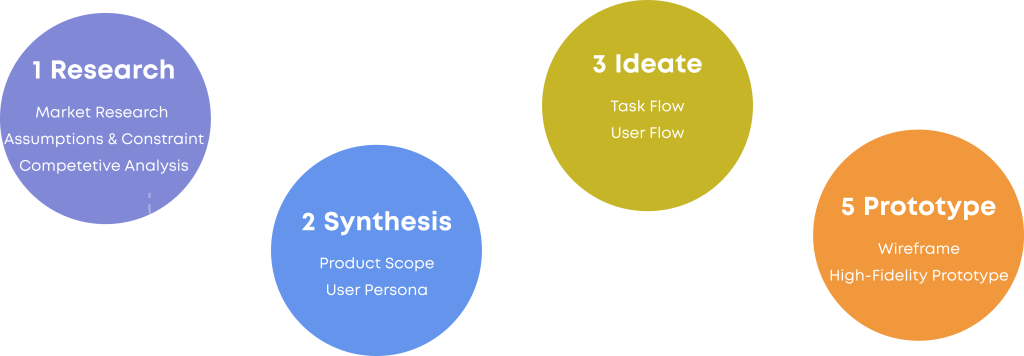

Provisional Persona

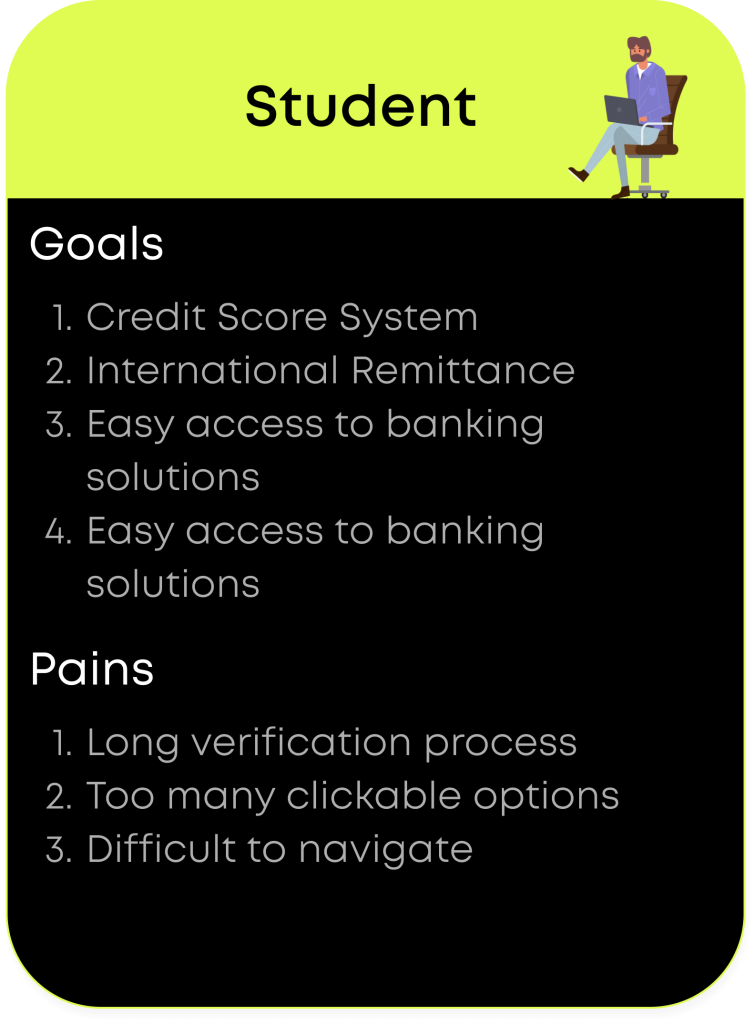

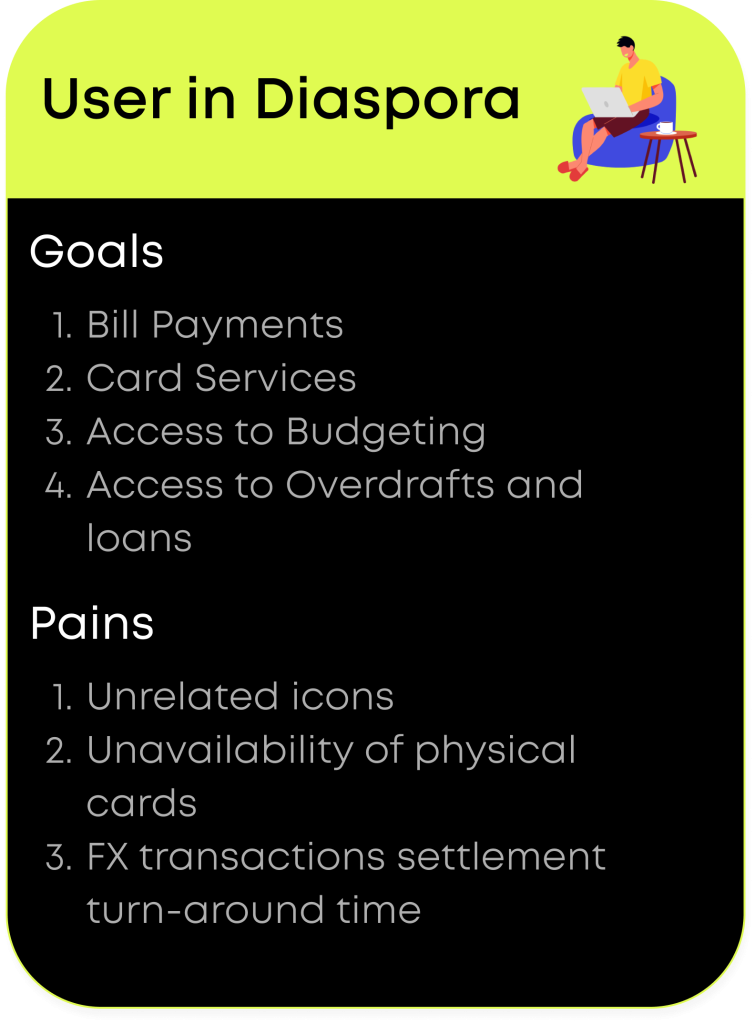

With the data gathered from market research, I started to generate provisional personas using the statistical knowledge I gained to represent a certain type of user that is potential audience of Bhuku. These personas will help me screen appropriate people to interview.

Primary Research

User Interview

Building on a general understanding of the market and the audience, I continued to dive deeper and build a real connection with our users, to gain direct insights into them through primary research. I created an Interview Guide to facilitate the user interview process, with 10 open-ended questions listed to invite the participants to share their experiences and stories. In total, 5 participants (3 males and 2 females) were interviewed about their reading and book-organizing experience (if there is any) in the past.

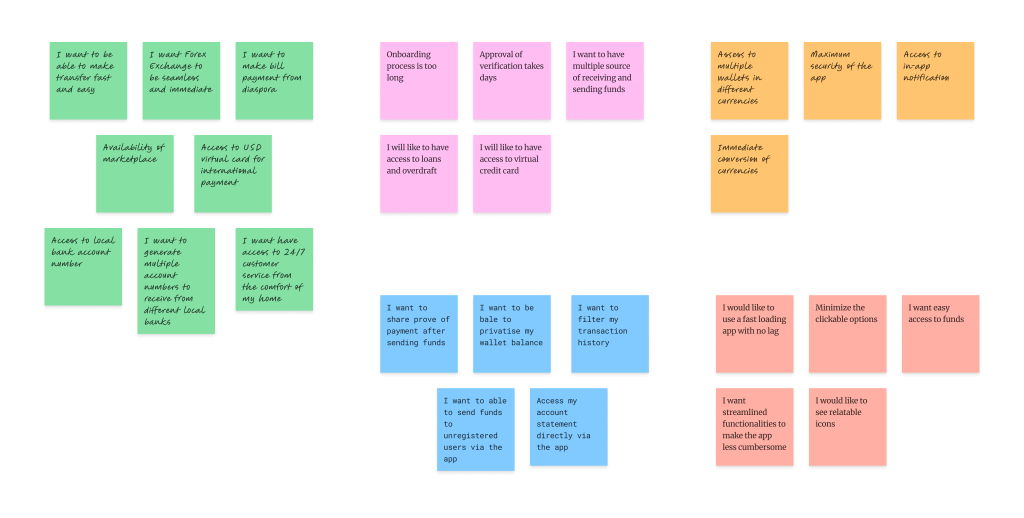

Empathy Map

To synthesize the qualitative data gathered from user interview, I created an empathy map to identify patterns across users, uncover insights, and generate needs.

02 Synthesis

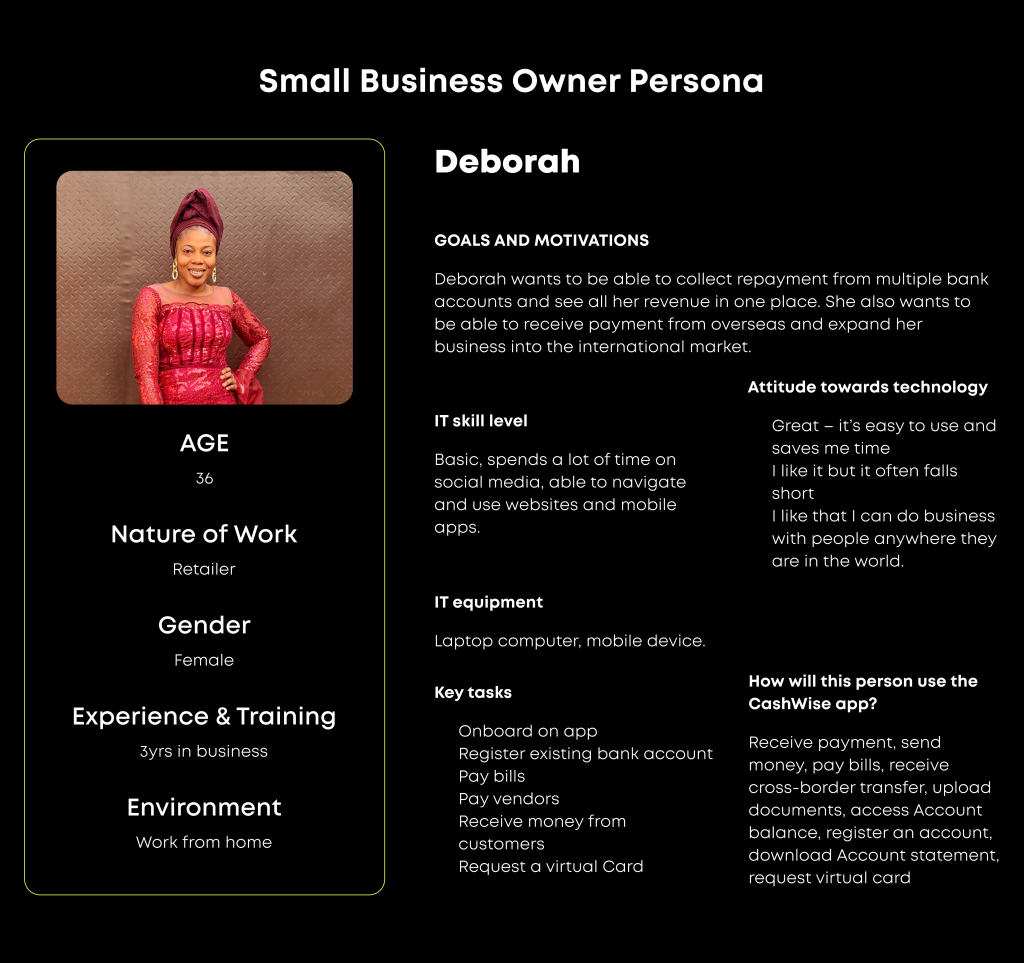

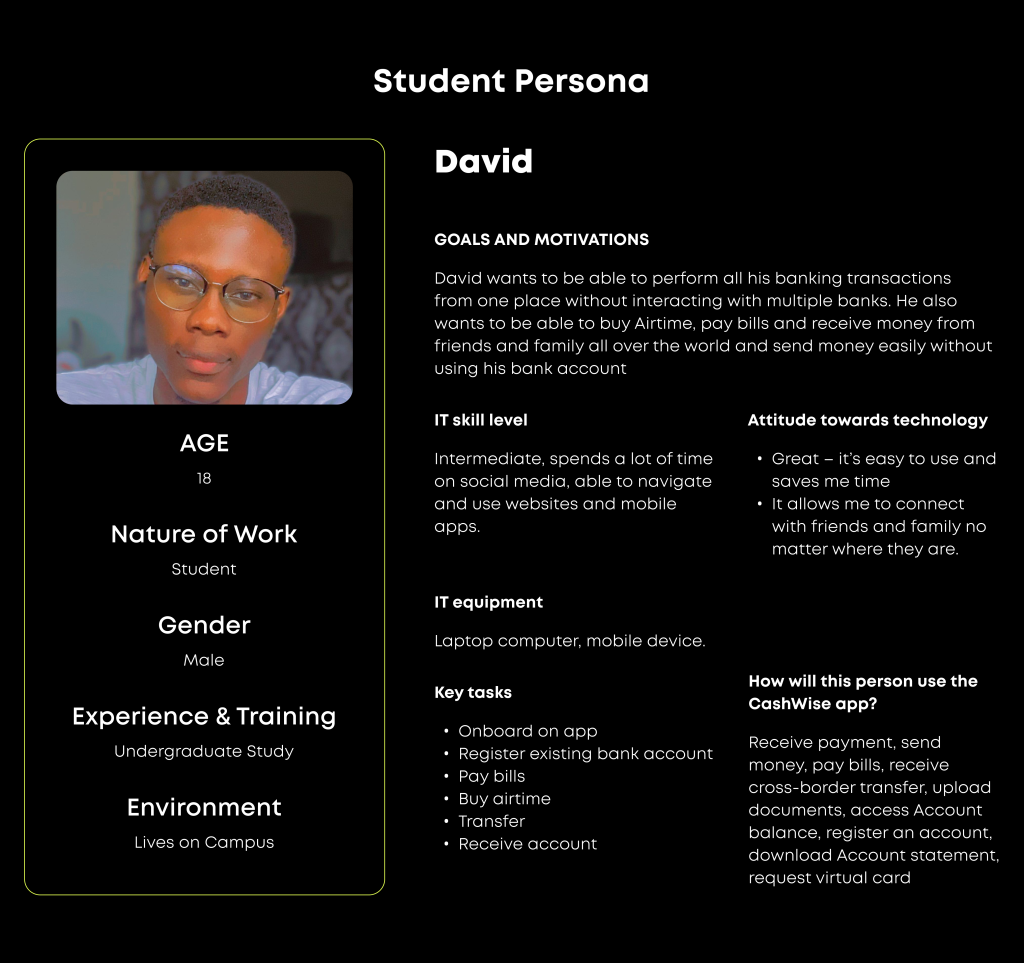

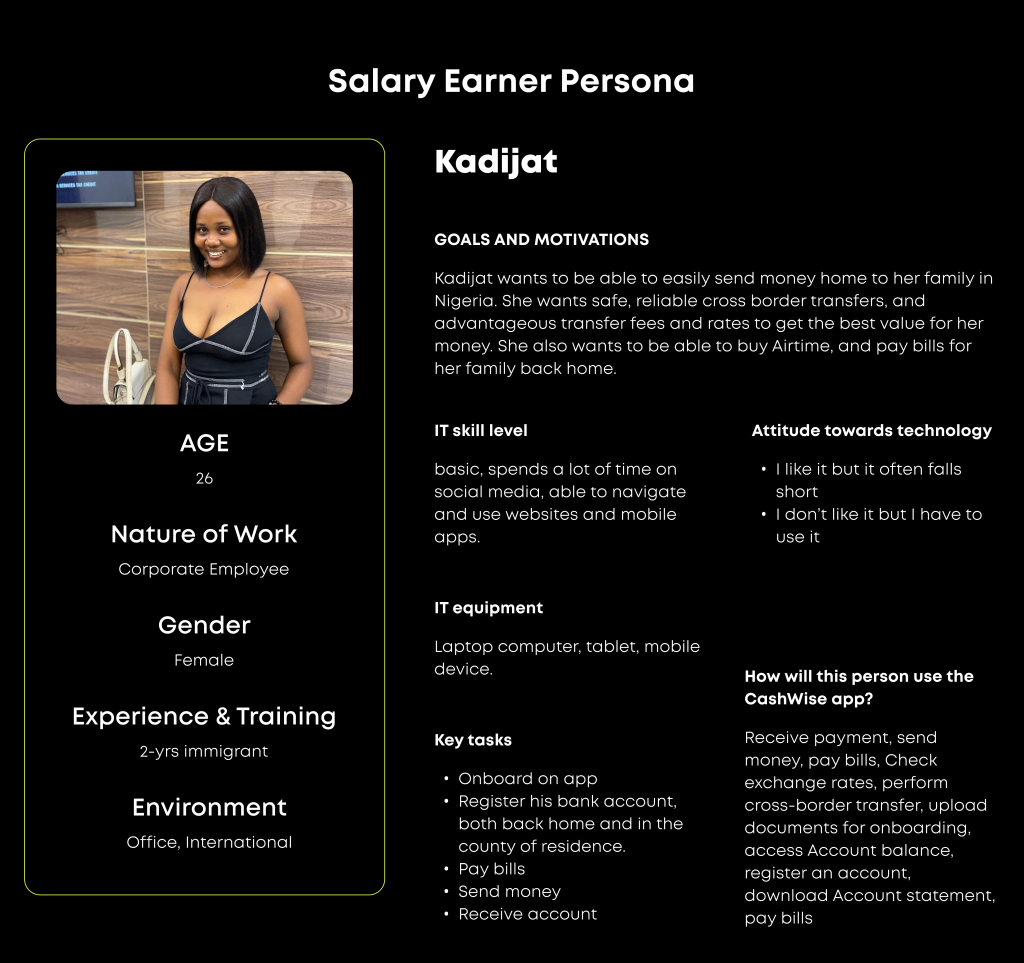

Research has shown that it is easier to empathize with a known individual than a group of people. therefore I decided to craft a persona for my target users.

Product Scope

The first version of the solution will feature its wallet system with payment capabilities to send and receive funds locally and internationally. The solution will be launched for the Nigerian market (locally) and users in a diaspora corridor (United States of America or Canada)

The following functionalities are what will be covered under the MVP of this product.

- User onboarding for Nigerians locally: Ability for legal residents within Nigeria to register with a valid email, telephone number and password..

- User onboarding for users in a diaspora corridor (UK/USA/Canada): Ability for legal residents in UK/USA/Canada to register with a valid email, mobile number and password..

- Verification of newly registered users: Legal ramifications and requirements to verify users in selected jurisdictions with means of ID. Primary means of ID for Nigerian users is Bank Verification Number (BVN) and those in diaspora is government issued ID

- User login: Ability for registered users to gain access to the app using correct email and password or biometric (fingerprint and/or face ID)

- NGN Cashwise wallet: Ability for users to fund, make payments and transfers in Naira to Cashwise user wallets and other bank accounts.

- Attach multiple virtual account numbers to NGN wallet: Ability to receive Naira transfers from Nigerian bank accounts using multiple variations of account numbers in different banks. Users in diaspora will have only one NUBAN attached to NGN wallet to receive Naira transfers.

- GBP/USD/CAD Cashwise wallet: Ability to make GBP/USD/CAD transfers to other users on Cashwise

- Send and receive money to bank accounts locally: Ability for users in Nigeria/UK/USA/CA to make transfers in their local currency to third party bank accounts in their region, Cashwise Tags and phone contacts, as well as receive money.

- Send and receive money internationally (outbound and inbound Nigeria): Make transfers in GBP/USD/CAD/NGN to other users on Cashwise within and outside Nigeria

- Card services: Create virtual (USD) cards, physical (Naira) cards and disposable virtual (USD) cards for local and international payments.

- Local bill payments (airtime, data, electricity, cableTV): Pay Nigerian bills for yourself and loved ones

- Notifications: Get real-time notifications of activities within your app

User Persona

Since I have gathered a bunch of knowledge of the audience, as well as their goals and needs, I use the user persona to represent key audience segments. It helps me focus on tackling the most important problems – to address the major needs of the most important user groups. It is both fictional and realistic.

03 Ideate

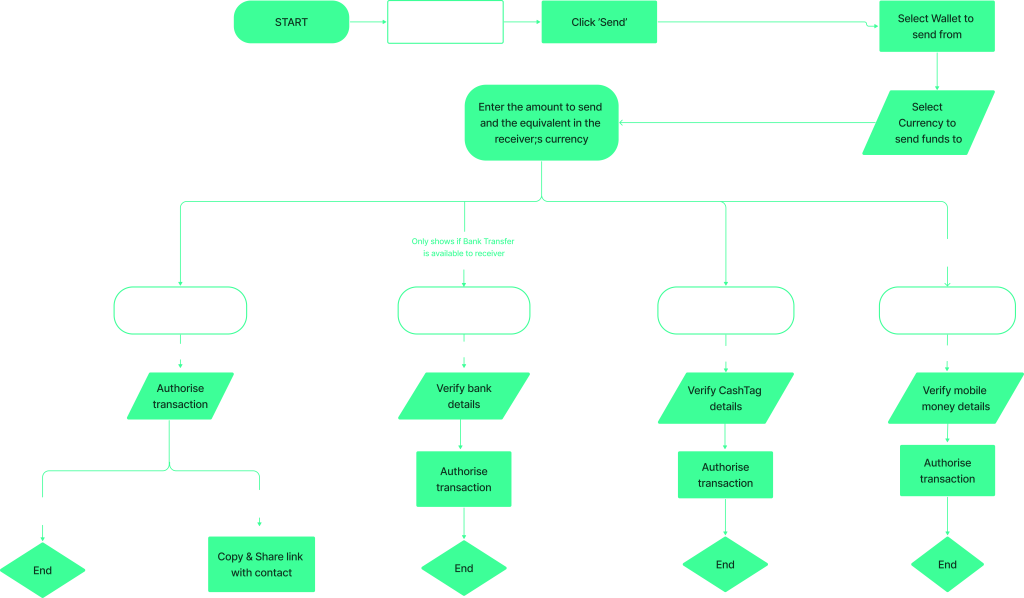

Task Flow

To assist the users to navigate through the application better and identify the main flow of users when they are completing a task, I created a task flows centring on the key features of Cashwise. In this way, I was able to decide what I am designing, and think through the necessary steps and examine the user experience in details. Below is the flow for each task.

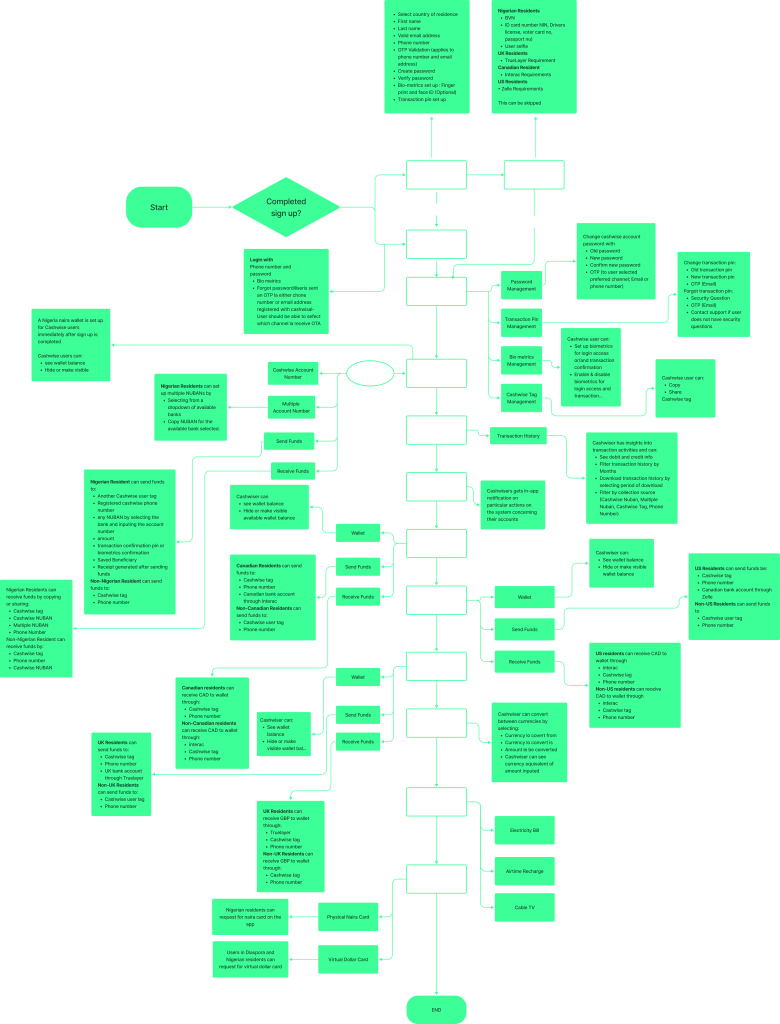

User Flow

Building on the task flow, I mapped user flows whose scenarios correspond to the established tasks. This process helps me walk in an individual user’s shoes, and think through different scenarios that this user might encounter. Below is the user flow for Cashwise when she wants to mark a book as “Want to Read”. A complete user flow can be viewed

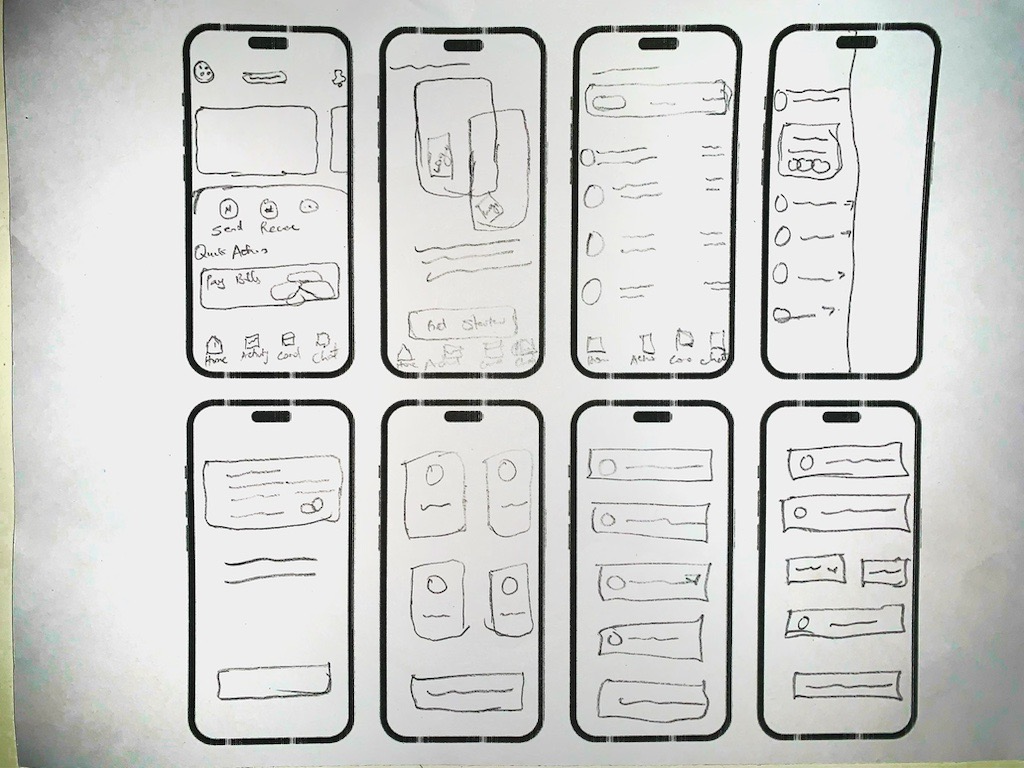

Low-fi Sketches

After establishing the pain point, with a to-do list for designing the key screens identified in the task flow and user flow. I sketched multiple low-fidelity screen options to test and see major functionalities to optimize the user experience. I can capture my ideas with pen and paper quickly by sketching. It also enables me to examine my ideas before putting everything in the daunting process of digitizing. After a few rounds of iterations, I came to a good place with the solutions.

04 Prototype

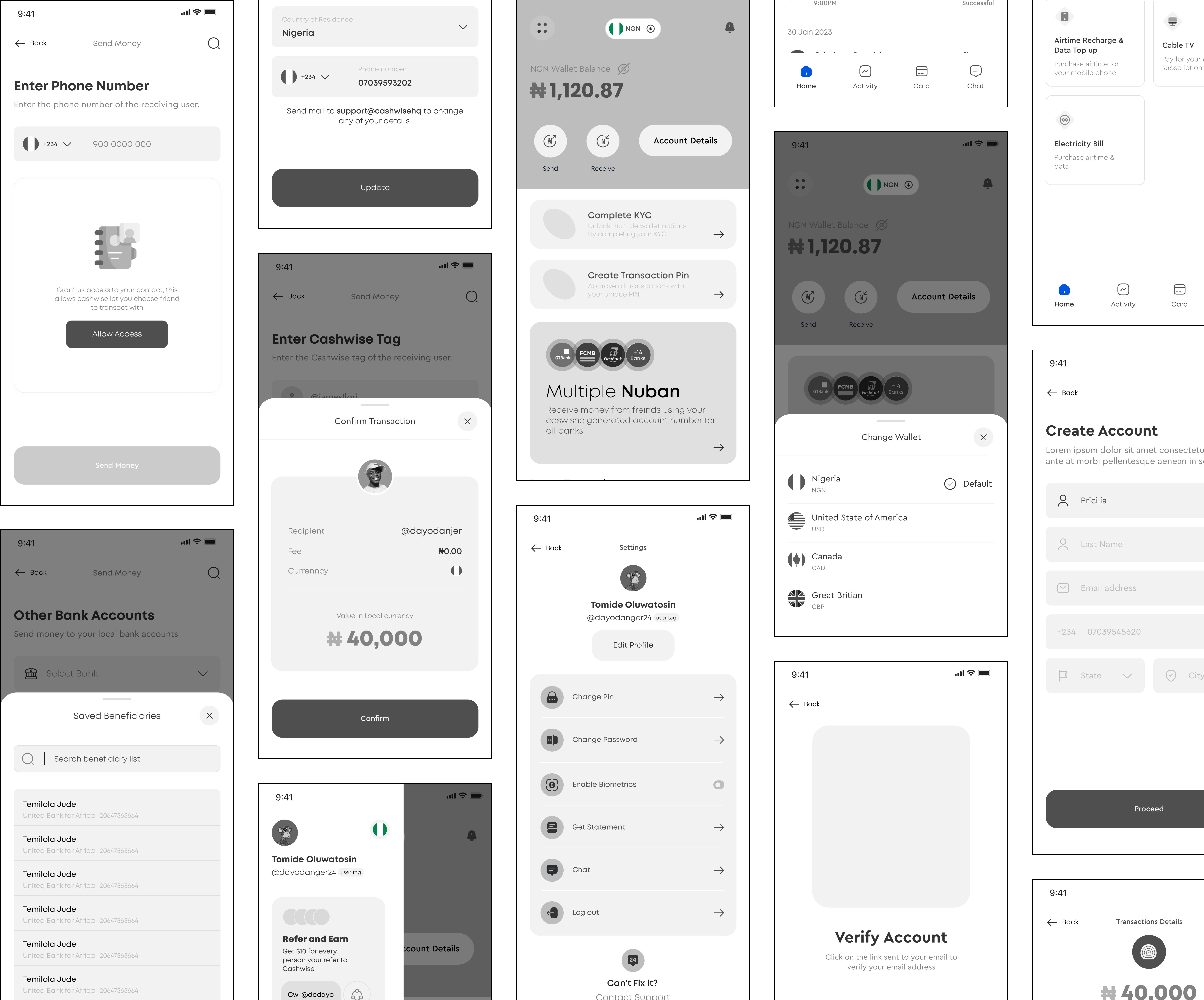

Wireframe

Once I had a visual direction of the layout, I started to add more details and precisions to the sketches by turning them into hi-fidelity wireframes. Creating mid-fidelity wireframes helps me have an already laid out view for the prototype, I tried to incorporate common design patterns that have been tested on our competitors’ product, or included elements that directly address users’ goals, needs, frustrations, and motivations.

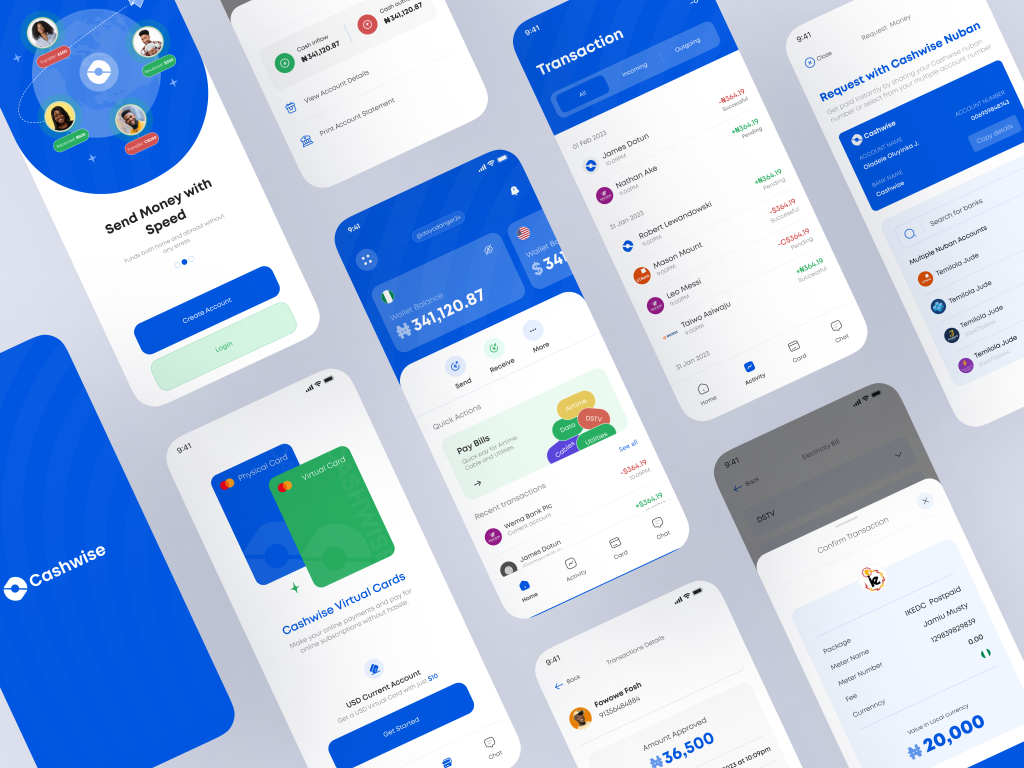

Hi-Fidelity Wireframes and Prototype

In the case of this project, I had to take the wireframe for a user review of some colleagues in the product design business to get feedback before moving to the hi-fidelity wireframe, which I got some really in-sighting feedback which then led to a lot of reiteration. After a long review of the wireframe, I then came to the perfect conclusion which meets my client’s expectations and requirements and also the user experience I was hoping to achieve.

Animated Prototype

Conclusion & Final Thought

After 8 weeks of hard work, I’m glad to finally put a full stop to the project. It’s been an amazing journey working on this product design job and seeing how it grew from a simple concept to a refined and polished product. As a creative, it’s been especially exciting to explore my own creative ideas and work with an incredible team who shared similar interests and points of view.

I had to cut corners at times, try different approaches to find the right answer, and even figure out what was wrong with certain details that didn’t look right. From the creative brief to the final version of the design, this job has been a great learning experience.

The outcome is something that I’m very proud of, and I’m looking forward to making more improvements as the project progresses. I’m confident that with the right feedback and some additional testing and optimization, this product is sure to make an impact.

It was definitely a challenging project, but nonetheless it was incredibly rewarding to see the product get crafted with such care and precision.